Financial Services and Blockchain Industry

The Blockchain is the trump card for many industries, including financial services. Its extreme flexibility proved a breakthrough in decentralized systems and now it’s only a matter of “who's first to implement” before everyone sees the benefit.

The distributed ledger is proving priceless at the moment, seeing as we can’t virtually assess the savings that could be made because we don’t fully understand the technology yet.

How can the industry approach this technology with caution and no collateral damage from previously set standards, or infrastructure?

Blockchain Technology Approach to Financial Services

Blockchains are amazing at independently-verifiable data. The speed at which it can verify data from contracts, e-mails, international data through API’s, etc, is unmatched.

This proved attractive to the financial services industry, mostly banks, to want to explore.

In November 2016, Deutsche Bank has made a very positive report called “Powering the flow of global capital” regarding the potential growth of the technology.

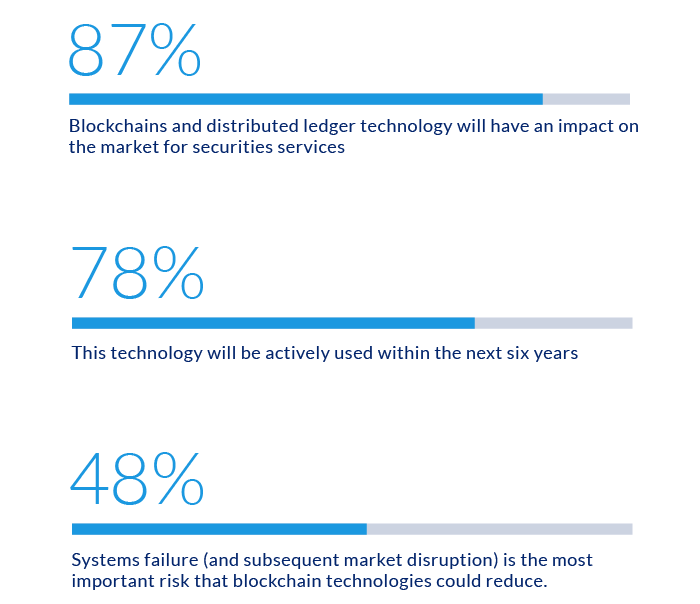

In this report, Deutsche Bank has stated that:

The growth we see here is quite important and is a product of all the Proof-of-Concepts being developed in the financial services industry, clearing out the misconceptions around this industry.

Why did Blockchain Go Financial Services First?

The idea of a Blockchain is not recent. Satoshi Nakamoto’s(the alias of the person or group of people) invention was brilliant, but the ideas date back to 1976 with Cipher Block Chaining.

This technique used an Initialization Vector to start the ciphering process, and afterward, the block cipher encryption created from the plaintext and the initial vector created the next key(vector) for the next block of encryption and so on.

This technique combined with Linked Timestamping, created by Haber and Stornetta in a 1990 paper, made the basis for Bitcoin and an immutable ledger.

Seeing as the first use of the technology is the Bitcoin, financial by nature, it is no surprise that the first industry to show incentive towards implementation were the banks.

According to one of our experts in Blockchain, Taulant Ramabaja, banks will, most likely, not be the first to implement it but they will be the industry that will most benefit from this technology.

This breakthrough technology is being weighed out day-by-day. While most believe that the pros will outweigh the cons, many also believe otherwise. With all the possible changes that will come, one is certain to happen, many jobs will be lost, seeing as the use of middle-men will be completely mitigated with it.

A blockchain-oriented bank is inevitable and the changes that come with it likewise.

The technology will prove to be valuable to financial services as much as robotics are to manufacturing, it will lead to job losses, but the good that comes with it is inevitable.

Banks will most benefit from the speed of the technology seeing as transactions can be verified and cleared much faster and easier with the use of it.

The speed factor will also conjoin with interoperability and this is where the main goal is. For banks to easily interoperate for transfers, loans, contracts etc.

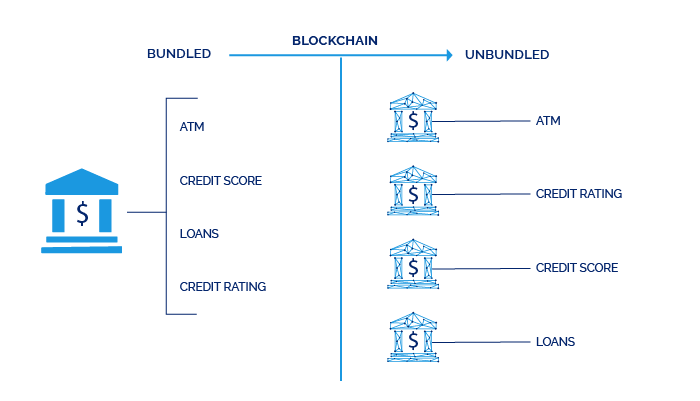

According to Taulant, another thing that banks will gladly accept is the unbundling of banking services.

For example, a bank currently provides ATMs, loans, credit ratings, credit scores, etc. The unbundling that will inevitably happen is that a bank will only be the connector to different applications, and a bank will only be the place where the money “sits”.

A good term that Taulant used was “Banks will become Banking-as-a-Service”. This will allow for banks to extend their reach beyond their local services because it will be much easier to implement their technology.

Other Use Cases in Financial Services

Other fields that will most likely see a major benefit will be supply chains as it will be much easier to track where the supplies are and what their product numbers are. Allowing real-time data of supply chains will be a major change.

Another is real time asset tracking. At the moment if an asset wants to be tracked and cleared for a loan, that process is a painful one. Going from contract to contract in a process that may extend a few days and include a pile of documents. Immutable ledgers could allow for real time clearance of loans, seeing as the data of assets could be implemented inside the blockchain and that would mean much easier verification.

The Blockchain Future and Speed Bumps

Scalability Concerns:

One of the main concerns of the technology is scalability.

The blockchain, in its current state, isn’t in a position where it could handle the rate of transactions that hegemon companies like Visa, or MasterCard have within a day.

Intel and its Distributed Ledger Technology named ‘Sawtooth Lake’ are looking to solve this issue.

In a recent trial done by R3 and eight members of its consortium; R3 and Intel concluded that with the use of Sawtooth Lake, the transaction rate of 100,000 transactions per day was possible with the current state of the technology.

Expecting only a rise of this number, the scalability issue might just prove to be only a shortcoming of investments, seeing as the growth of the technology is proving again and again that we have only scratched the surface with it.

Security concerns:

Another main concern is security. Although very secure in its current state, blockchain still has a long way to go if it wants to augment on top of bank infrastructure.

A recent white paper by the European Union Agency for Network and Information Security (ENISA) aimed to highlight the possible challenges that financial services may face if they do decide to implement it.

Data privacy, smart contract oversight, and proper management were the key points.

Decentralization concerns:

Another aspect is its decentralization. By nature, the technology was designed as decentralized. Companies that want to implement it would want a central governance. This allows for rules to be placed, the resolution of issues, and many other activities.

This is also one of the key points in regards to it getting the much-needed pickup from a larger hierarchy.

Regulation issues:

When it comes to Bitcoin, the controversy was mostly about how do we go around regulating this currency/commodity/whatever-this-is?

It wasn’t that simple. No jurisdictional laws applied to Bitcoin, seeing as there was no central person to refer to when it came to any issue. No country took responsibility for it, so Bitcoin was stuck in the state it was first developed in.

Blockchain in financial services is running into the same issue as the Internet did before the TCP/IP regulations where everyone had their own vendor protocols and interoperability was a tedious process. Some major companies are working towards a stateless protocol, so whoever develops the first stateless protocol, will have invented the “next TCP/IP”.

Proof-of-Concepts: Seemingly stuck in a perpetual-state of proof-of-concepts, some companies have started to take it real time. What is mostly missing is education. Many companies get blockchain completely confused and that’s why the Proof-of-Concept stage is so important.

Reserve Bank of India recently cooperated with a blockchain solutions company to finish a proof-of-concept that uses already-present infrastructure, protocols, etc. Proof-of-Concepts are usually done in closed sandbox environments, but this was one of the first times that the technology was used in an end-to-end test.

Other promising Proof-of-Concepts that are being developed, for example, we, at Bitsapphire, are developing a government identity service, where your ID, passport, driver’s license, etc, can be cleared and identified much easier. This is all being done through the digital ledger and the advantages that come with it.

Solutions are in the Blockchain:

The state where Blockchain is currently in making it a good target for nitpicking everything, and for a good reason, but nevertheless it does make for a tough crowd when it comes to implementation, seeing as everything about it screams to skeptics.

But that is proving to be nothing but a speed bump on the road to mass-scale adoption.

The technology is picking up steam and with the current state of the Internet, scandals of net neutrality, violations of privacy, it’s no random occurrence that it is.

“You can’t stop things like Bitcoin. It will be everywhere and the world will have to readjust.

World governments will have to readjust”

John McAfee, Founder of McAfee.

So as we look to readjust, maybe we can even stretch the borders of this technology beyond what is currently possible.